This chapter contains the following topic:

Introduction to Distributions to G/L

This selection enables you to print a report of distributions to General Ledger.

| • | If you use a manual General Ledger system, you can enter the distributions into it using this report. |

| • | If you use a computerized General Ledger (either Passport’s or another vendor’s), you can interface the distributions directly, since they are written to a file or table in addition to being printed. The Get distributions selection in G/L receives them into the G/L module. |

If desired, Distributions to G/L also purges the distributions. However, do not purge the distributions until the data has been pulled into General Ledger.

Posting transactions (entries) in Invoices, Miscellaneous charges, Cash receipts, and Finance charges results in distributions to the various accounts in your general ledger. This selection lets you print out these distributions at intervals (normally corresponding to your accounting periods).

If you checked the box or entered Y to Summary post distributions (in Control information), you will not be able to show detail.

The report is in three sections: Income, Cash Receipts, and Net Change to Accounts Receivable:

| • | Income section. This shows transactions entered for particular G/L accounts through Invoices and Miscellaneous charges. |

| • | Cash Receipts section. This shows transactions entered for particular G/L accounts through Cash receipts. This includes distributions for cash, discounts, allowances, and credits to non-A/R accounts. |

| • | Net Change section. This is a summary of the first two sections by account number, and shows all debits and credits to each accounts receivable account. These can be shown in detail, or summarized by day. |

The dates used are the dates of the sales or cash receipts transactions, not the dates on which the transactions were posted.

A sample Accounts Receivable Distributions To General Ledger Report is in the Sample Reports appendix.

Select

Distributions to G/L from the Reports, general menu.

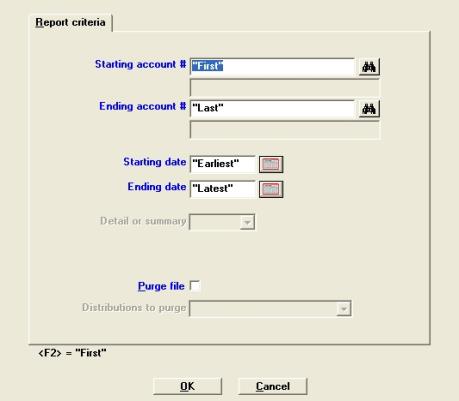

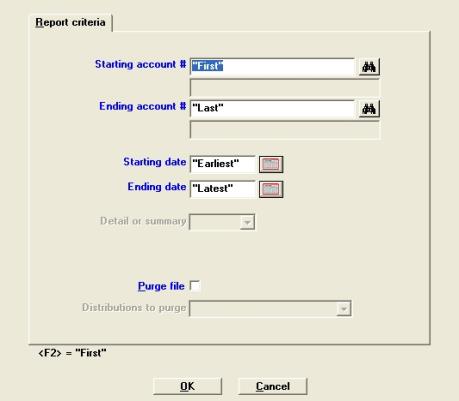

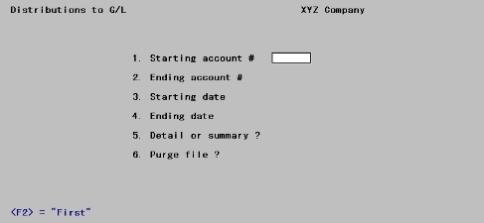

The following screen appears:

Graphical Mode

Character Mode

Enter the following information:

Starting account # and

Ending account #

Specify the range of account numbers to include. You may use the option:

Options

|

<F2> |

For the First starting account number or Last ending account number |

If you intend to purge (Field #6 below), you must specify First through Last here. Purging only some accounts would put the distributions out of balance whether or not the Passport Business Solutions G/L is interfaced.

|

Format |

Your standard account number format, as specified in Company information. |

|

Example |

Press <F2> at each field. |

Specify the range of dates for distributions to G/L. Transactions are selected for inclusion on the basis of their entry date, not their posting date. You may use the option:

|

<F2> |

For the Earliest starting date or Latest ending date |

|

Format |

MMDDYY |

|

Example |

Type <F2> for a starting date of earliest, then type 043005 |

If you have answered Y to Summary post distributions (in Control information), this field displays as (Not applicable).

Otherwise, you can print the report in full detail, showing every distribution made for every transaction posted; or print it in summary.

Enter D to print the detailed report or S to print the summary report.

|

Format |

Graphical: Drop-down box, either Detail or Summary Character: One letter, either D or S |

|

Example |

Type D |

If any account number range other than First through Last has been specified (in Fields #1 and #2 above), this field displays as (Not applicable) and may not be changed.

Otherwise, answer Y if you wish the data to be purged after it is printed, or N if you do not. The report is printed in either case.

In a multi-user environment, you should not purge distributions while another user is posting either invoices, miscellaneous charges, or cash receipts.

|

Format |

Graphical: Check Box, where checked is Yes and unchecked is No Character: One letter, either Y or N |

|

Example |

Type N |

This field appears only if the Passport Business Solutions G/L is interfaced and you have answered Y to the preceding.

Type 1 or 2 to select which distributions to purge:

If you type 1, all distributions within the date range entered above will be purged, regardless of whether they have already been transferred to G/L (by means of the G/L Get distributions selection).

If you type 2, only those distributions will be purged which are within the date range and which have already been transferred to General Ledger.

|

Format |

Graphical: Drop-down box. Either all dists in rangeor only interfaced dists in range Character: One digit, either 1 or 2 |

|

Example |

(This field does not occur in this example because you responded N to the preceding field.) |

Make any needed changes, then press <Enter>. The Distributions to G/L Report will be printed and (if you so specified) the transactions will be purged. There will be a period of processing while this occurs.

If the Passport Business Solutions G/L is not used

The A/R Distributions to G/L Report lists the debits and credits which must be entered into your manual ledger.

You should print out this report at the end of an accounting period after all A/R transactions have been entered and posted for the period.

You may wish to print the report to disk and then obtain a printed copy using Print reports from disk. In this way, you can retain a copy of the report on the hard disk in case a spare copy of the report should be needed.

If the Passport Business Solutions G/L is used

The A/R Distributions to G/L contains debits and credits (created by A/R transactions) that must be transferred to the Passport Business Solutions General Ledger.

This is done from the G/L Get distributions selection. Specify that you want to get distributions from the A/R module. Refer to the Distributions chapter in the G/L User documentation.

Prior to running Get distributions, Passport recommends that you first print the A/R Distributions to G/L Report.

| • | All accounts should be printed. The date range should include the entries you will be transferring to the G/L. |

| • | Do not specify that the data is to be purged! If you purge distributions here in A/R before transferring them to the G/L module, you would have to enter these distributions again manually in the G/L module, using General journal. This would defeat the purpose of the Get distributions selection. |

| • | The purpose of printing this report is to obtain an accurate list of the debits and credits that are to be transferred to G/L. |

| • | You may wish to print the report to disk and then obtain a printed copy using Print reports from disk. In this way, you can retain a copy of the report on the hard disk in case a spare copy of the report should be needed. |

After printing the report, back up your data and run G/L Get distributions. When running this selection, specify that the distributions are to be purged as they are copied to the General Journal Transactions. If a power failure (and computer crash) should occur while running Get distributions, simply restore your backup and repeat the procedure.

Once Get distributions has been run, print an Distributions Edit List and compare this report with the A/R Distributions to G/L Report to verify that all debits and credits have been transferred.

An alternative procedure is as follows:

| 1. | Back up your data. |

| 2. | Run Get distributions, specifying that distributions are not to be purged. |

| 3. | Run Distributions to G/L, specifying that the data is to be purged and only interfaced distributions are to be purged. |

| 4. | Print the Distributions Edit List. The debits and credits printed on the edit list should be comparable to the debits and credits on the A/R Distributions to G/L Report, provided that you have followed this procedure each period. If you have not purged the A/R Distributions to G/L in a previous period the reports may not be comparable. |

Note that if you specify that distributions are not to be purged by Get distributions

, and you run Get distributions again, you will still never transfer the same distribution from A/R to G/L more than once, because Get distributions prevents this. Thus, if after step (2) in the alternate procedure above you discover additional A/R transactions for the accounting period which have not yet been entered into the PBS A/R, simply enter and post these transactions in A/R, and repeat the alternate procedure starting with step (1).